Advanced functionality for purchase documents

In some contexts, domestic purchase documents must include different types of items, some of them subjected to reverse charge VAT and others subjected to normal domestic VAT.

This is the case for the construction sector, with the introduction in the UK of a new regulation to enforce domestic reverse charge VAT for construction services.

You can automate the reverse VAT charge calculation and posting only for specific items in purchase documents and AP invoices using advanced settings. The principle is to create an additional tax that reverses the VAT calculated at the line level.

Settings

BP tax rule (GESTVB)

Suppliers must have a Normal BP rule type. You can create a specific BP tax rule to ease the tax determination.

Tax level (GESTVI)

Open: Common data > Common tables > Taxes > Tax level

Domestic tax level

Products must have a “normal” tax level for the domestic tax. You can set-up specific tax levels to ease the tax determination.

Reverse of the domestic tax level

Products must have a specific tax level that triggers the calculation of the reverse charge VAT.

Products (GESITM)

Open: Common data > Products > Products

You must associate these two tax levels to the relevant products so that when entering these products in a purchase document, domestic taxes and their reversals are triggered, if you have correctly set-up the tax determination rules.

Tax rates (GESTVT)

Open: Common data > Common tables > Taxes > Tax rates

Domestic tax rate

The domestic tax rate must exist. You can set-up specific tax rates to ease the tax determination and/or VAT box determination.

Normal domestic tax rate - Reversal

This tax rate corresponds to the reverse charge VAT:

-

If the Tax type is Additional tax or Special tax, Sage X3 accepts one VAT tax at the line level, and two other taxes, Additional or Special. See the documentation for more details.

-

The BP tax rule is must correspond to a Normal Tax rule type.

-

The rate is the normal domestic rate but negative.

Tax determination (GESTVC)

Open: Common data > Common tables > Taxes > Tax rates

You must define the tax determination rules so that when entering a purchase transaction, the domestic VAT is calculated, and its reversal is triggered.

Domestic tax code determination

You associate the relevant BP tax rule and Product tax level to determine the domestic VAT code and the linked rate.

Reverse domestic tax code determination

You associate the reverse domestic tax code with the associated rate for the relevant BP tax rule and Product tax level.

Process

When selecting the right association of business partners and products, Sage X3 automatically applies the relevant tax rules at the line level, including normal VAT and reverse charge VAT.

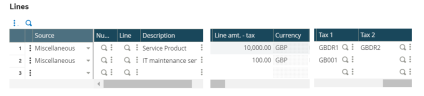

For example, when creating a purchase invoice with the relevant supplier, and when using two different products set-up differently, Sage X3 only calculates the reverse charge for the relevant product:

-

The first product (SERV016) is triggered by setting the domestic tax for construction service GDDR1 as tax code 1 and the reverse charge tax GBDR2 as tax code 2.

-

The second line is triggered by setting the normal domestic tax GB001 as tax code 1.

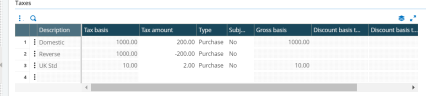

The tax summary is the following: