File a federal GST return

You can extract values and create a preparatory federal GST return by taking advantage of the VAT framework within Sage X3

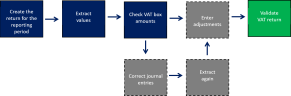

GST extraction workflow

This workflow is an overview of functions and settings required to generate the preparatory report or submit directly from Sage X3. These functions are part of the VAT framework.

-

VAT boxes (GESVTB): Set up the relationship between your tax codes and the GST-34 lines.

-

VAT form (GESVEF): Define the VAT return structure based on the VAT box setup for a specific period.

-

VAT entity (GESVATGRP): Create a VAT entity for one or multiple companies or sites used for the actual VAT return.

-

VAT return (GESVFE): Extract, review, and validate the amounts to declare based on your accounting entries and the previous 3 steps. Use one of the submission methods below:

-

Generate the paper return manually as a PDF.

-

Generate the NETFILE for upload to the Canadian Revenue Service online portal.

-

Limitations

The GST and HST return functionality only supports accrual-based accounting, or VAT on debit. Cash-basis accounting, or VAT on payment, is explicitly not supported for the Canadian GST return in Sage X3.

Unextracted entries, such as late transactions, are currently not supported.

You cannot extract PST declarations.

Set up VAT boxes

Open: Declarations > Tax management > Others > Setup > VAT boxes

In the VAT boxes function, you can use the DCLVATCAN script to generate the VAT box structure that is compliant with the GST-34 return.

Define the VAT return structure

Open: Declarations > Tax management > Others > Setup > VAT form

In the VAT form function, use the predefined CANVAT form. You can reuse the same form for different years, different VAT entities, and so on.

VAT form in offline mode for manually submission

When a VAT from is in online mode, the Online submission mapping field is available. You can select CANGST for the predefined mapping to the Tax UID codes. In most cases, you do not need to modify these mappings unless you have a specific business need.

VAT form in online mode for online submission

You can create several mappings per legislation that can be linked to different VAT forms. If you make changes, select TaxUID consistency check to generate a log file that displays any errors between the mapping and the VAT form.

See the online help for Online submission mapping and Tax UID management for detailed information.

Create a VAT entity

Open: Declarations > Tax management > Others > Setup > VAT entities

Use this function to create and manage VAT entities for a single or multiple companies or a single or multiple sites. And you can define separate VAT returns at the site level for a VAT entity.

You need to identify a Head member, which can be a company or a site. Information related to the Head member, such as address and tax number or identifier, is used for extraction and submission. All members in an entity must have the same legislation.

Extract amounts to declare

Open: Declarations > Tax management > Others > Processes > VAT returns

In the VAT returns function, extract values for the GST return using the VAT form you created. After you extract the values, you can review and make adjustments as needed and run another extraction. You can extract in actual or simulation mode.

Validate the results to generate the file to submit to your tax authority. After validating, you can no longer make any adjustments.

When you extract, values display in the VAT to declare grid. In simulation mode, only simulated values display. The Extracted value column populates when you extract in actual mode.

Submit the return

When you extract the amounts in actual mode and validate those amounts, you are ready to prepare a file for submission: PDF for offline or NETFILE for direct, online.

Offline submission

You need to generate the GST-34 return working copy as a PDF. Use the Print button to create the PDF and manually complete the online form in the My Business Account web portal.

The PDF provides data to facilitate completing the paper form or the online form. It is not intended to be filed directly with the Canadian tax authority.

Sample PDF working copy

Online submission

After you validate, the Submit button is available.

Selecting Submit opens the GST/HST Submission details window in a new browser tab.

For Return type, select NETfile & PDF Generation and select Create GST/HST Return. Values from Sage X3 are transmitted, calculated, and assigned to the relevant VAT boxes.

When the process finishes, the amounts display for each VAT box in the GST/HST Guidance window. Select Edit next to each box to make adjustments.

When you have completed the online submission process and have generated the final report, you can close the window and go back to the VAT returns function. The adjustments you made to the online form display in the Adjustment columns in the VAT to declare and Detail by company grids.

Complete the online submission

After you have completed the online submission and have gone back to the VAT returns function, there are additional actions you can take.

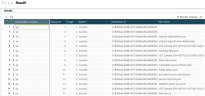

After checking the status, select Result to view the most recent submission information, as shown below:

This window displays the submission status for the online submission.

For each online submission, there is a unique Execution ID. This is needed if you contact support for technical issues with the submission.

From the Result window you can download the result file in PDF format if you did not download it during the online submission process.

Cancel an online submission

Before an online submission is complete, you can select Cancel submission. For this option to be available, the status must be Pending.

If there are errors, technical issues, or if a submission in progress cannot be resumed, canceling could be necessary.