Setting up the VAT structure

You can set up the VAT structure with presettings delivered specifically for South African legislation.

Functions used in setting up the VAT structure

You do not need to do these tasks for every declaration. After you have done the necessary work in each function, you can create multiple declarations.

-

VAT boxes (GESVTB): Set up the relationship between your tax codes and the VAT201 lines.

-

Entry type groups (GESGTEGRP): Set up an entry type group code to use for detail VAT boxes on a single line rather than entering multiple lines for detailed entry types. This step is optional.

-

-

VAT form (GESVEF): Define the VAT return structure based on the VAT box setup for a specific period.

-

VAT entities (GESVATGRP): Create a VAT entity for one or multiple companies or sites used for the actual VAT return.

Setting up VAT boxes

Ouvrir : Declarations > Tax management > Others > Setup

In the VAT boxes function, enter the DCLVATZAF1 code to generate the VAT box structure and related box codes compliant with the South African VAT declaration.

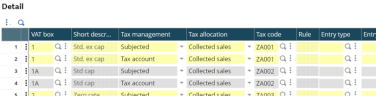

In the Detail section, you can assign VAT codes to the appropriate boxes and define the tax management details.

Using VAT entry type groups

Ouvrir : Declarations > Tax management > Others > Setup > VAT entry type groups

If you created a VAT entry type group, you can use the entry group code for detail VAT boxes on a single line rather than entering multiple lines for detailed entry types. Entry type groups share the same tax code + tax management + tax allocation combination.

Defining the VAT form

Ouvrir : Declarations > Tax management > Others > Setup > VAT form

Use the ZAFVAT form to create the structure for the VAT returns declaration. You can reuse the same form for different years, different VAT entities, etc.

Setting up a VAT entity

Ouvrir : Declarations > Tax management > Setup > VAT entities

You need to create a VAT entity even if you are generating a VAT return for a single company or site. You can create and manage VAT entities for a single or multiple companies or a single or multiple sites. VAT entities enable you to define distinct VAT returns at the site level.

One company or site in the entity must be identified as the Head member. Information related to the Head member, such as address and tax number or identifier, is used for extraction and submission.