Overview

The South African VAT declaration has been integrated into the global VAT framework. Within the framework you can take advantage of a preset VAT box structure, a predefined VAT form that can be reused multiple times, and a VAT entity group to create declarations for a single or multiple companies or a single or multiple sites.

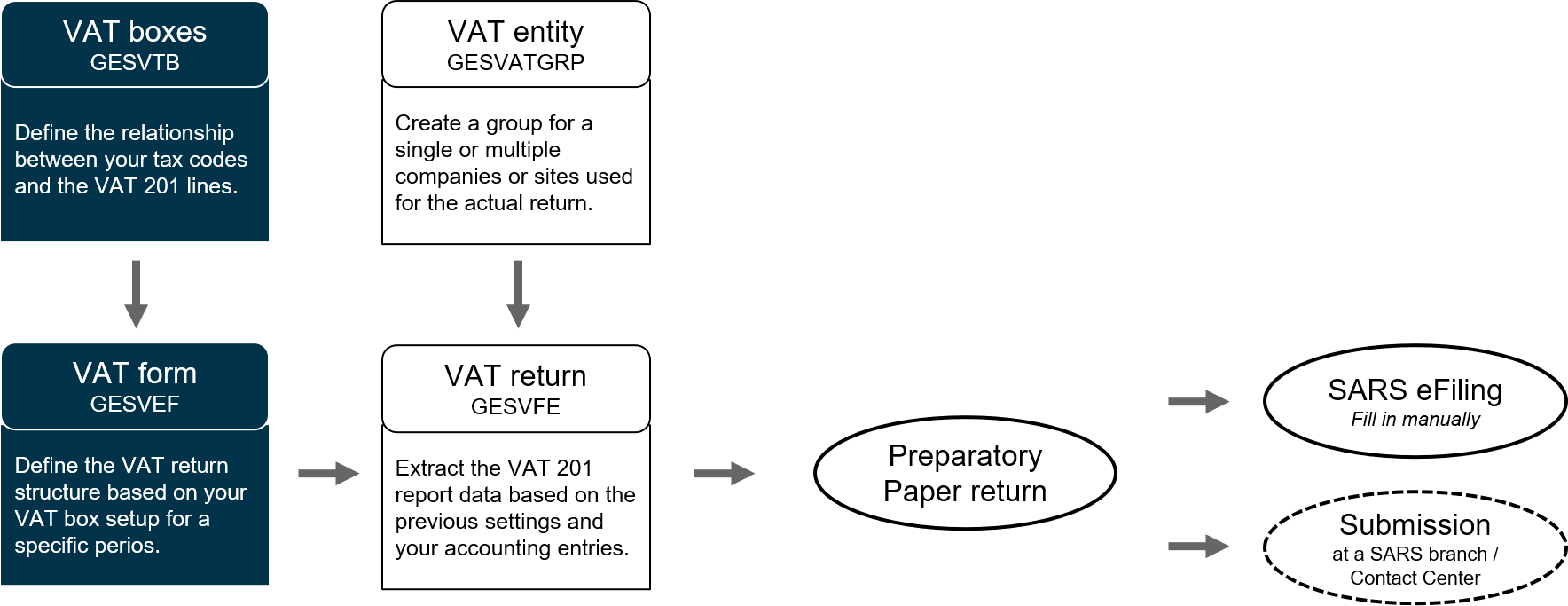

VAT return workflow

This represents an overview of the process. See the respective sections on Setting up the VAT structure and Extracting and validating data for details.

Functions in the VAT framework process

-

VAT boxes (GESVTB): Set up the relationship between your tax codes and the VAT201 lines.

-

VAT form (GESVEF): Define the VAT return structure based on the VAT box setup for a specific period.

-

VAT entity (GESVATGRP): Create a VAT entity for one or multiple companies or sites used for the actual VAT return.

-

VAT return (GESVFE): Extract the VAT201 report data based on your accounting entries and the previous 3 steps.

-

VATRETURNS report: Print the VAT201 preparatory report.

-

Submit a paper return at a SARS location.

-

File online.

-

-

VAT return extraction (VFECLC): Extract for multiple returns and run as a batch task.

The VAT framework includes dedicated functions designed to facilitate calculating and validating VAT returns but does not include direct submission from Sage X3. For specific legislations, including the South African, there is a preset structure for VAT boxes and tax file generation that conforms to the respective tax laws. There is also a generic VAT declaration that can be customized for legislations not part of the framework.

Within the VAT framework, the company legislation and the VAT declaration process are separate.

Changes to the current VAT process

As of May 2021, there are important changes as a result of the VAT framework integration.

-

The VAT declaration function (DCLVATZAF) has been deprecated.

-

Preparatory reports for new declarations are run in the VAT returns function (GESVFE).

-

The recurring task code DCLVATZAF can no longer be used in the Recurring tasks function (GESABA). You can use the VAT return extraction function (VFECLC) for batch tasks.

-

The RSAVAT - South African VAT parameter (LOC chapter, RSA group) is no longer needed.

-

The DCLVATZAF VAT box setup has been replaced with DCLVATZAF1. You can reprint declarations generated before the May 2021 using the DCLVATDEBZAF2 - South African VAT declaration report.

Limitations

The Value-Added Tax (VAT201) Declaration includes several sections. Sage X3 only supports:

-

Calculation of Output Tax and Imported Services

-

Calculation of Input Tax

VAT on payment and the following sections are not supported:

-

Diesel

-

Contact details

-

Voluntary Disclosure Programme (VDP)

-

Tax Practitioner Details (if applicable)

-

Calculation of Diesel Refund in terms of the Customs and Excise Act